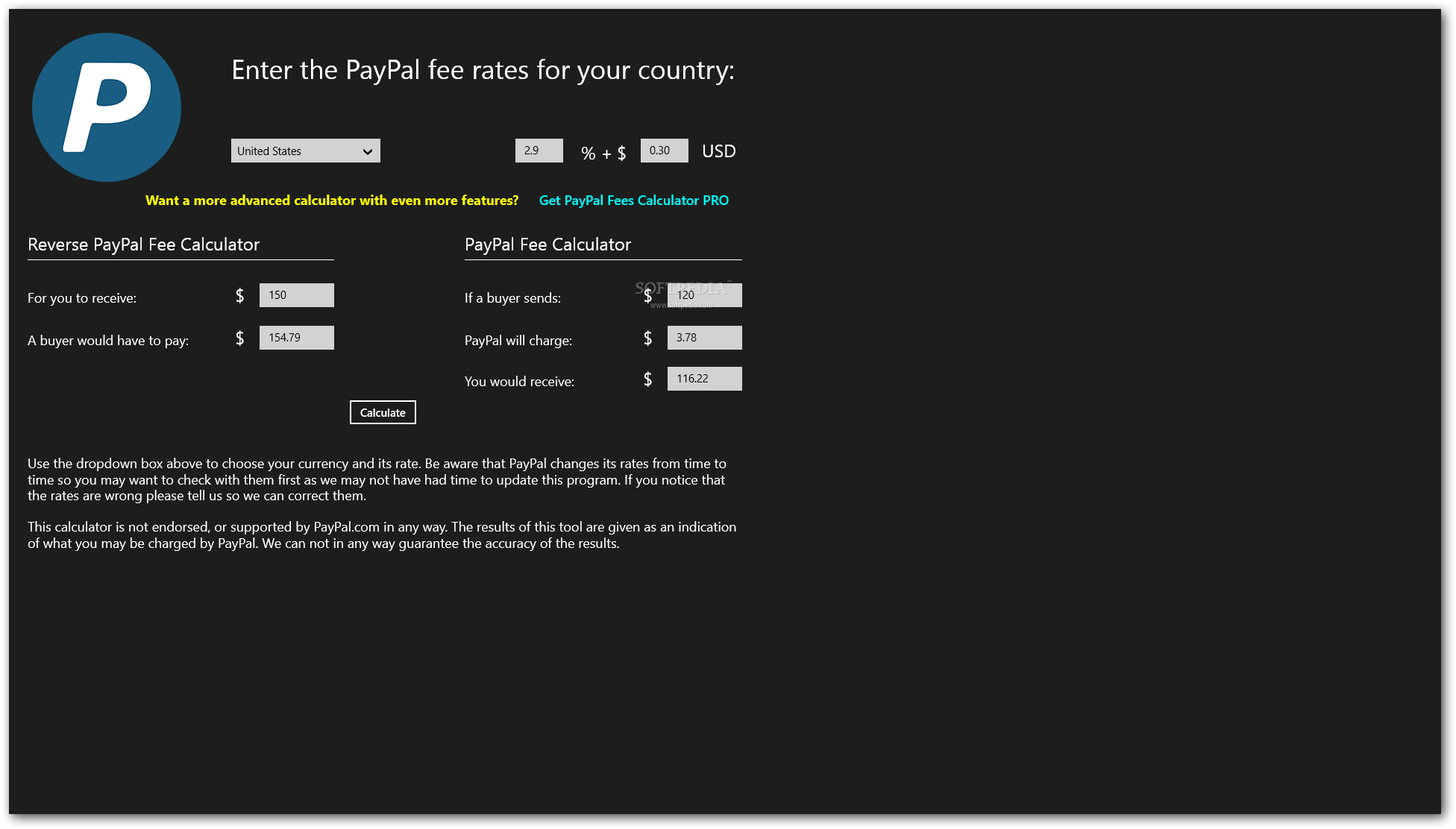

In addition to PayPal fees, you can also toggle over to Stripe to see how those fees compare. Estimate your costs for digital checkout, in-person Zettle transaction, or standard debit or credit card payment. There are many free tools out there, including: You can use a PayPal fee calculator instead of relying on your own calculations.

Paypal fees calculator plus#

When receiving payments from outside of the US, you’re charged the same domestic fee plus an additional 1.5% of the transaction and another fixed fee based on the currency.ĭisclaimer: These numbers are accurate as of the published date, but may be subject to change. For example, a payment of $50 will be charged a $1.99 processing fee ( $1.50 + 49¢). Then, if you’re processing a credit card, you’ll have to pay 2.99% plus a 49¢ flat fee (this amount is based on the currency of the payment).

If you’re selling in the US, you’re charged 2.99% of the transaction amount in order to receive money via PayPal transfer. Often this is charged as a percentage of the transaction plus a fixed fee.įees vary depending on the transaction type, seller location and currency, and buyer location and currency.

If you’re a consumer purchasing goods and services in the US you don’t pay any fees for using PayPal, but if you’re a merchant selling goods or services, you’ll have to pay a fee. PayPal does not charge a fee for consumer-to-consumer money transfers. PayPal is a for-profit company, so it looks to earn a profit after paying all of its operating expenses. PayPal charges a fee for merchants to use its platform. Fees are applied either as a percentage of the transaction amount or as a flat fee, depending on how you’re sending or receiving money. PayPal fees are the costs associated with using the platform to process payments and send or receive money.

0 kommentar(er)

0 kommentar(er)